Below is an illustration (a fictitious one) with three things to consider upon the death of a spouse who owns a business.

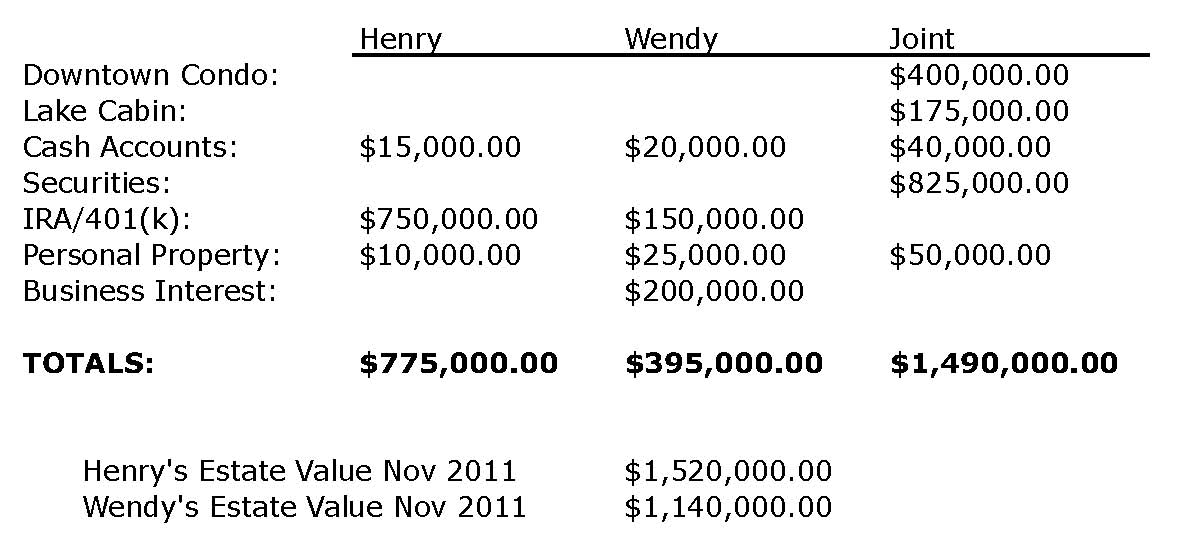

Henry and Wendy celebrated their 30th anniversary last summer with their two children and three grandchildren. At the time of her death in November 2011, Wendy owned an increasingly successful retail business. Henry has been retired for four years. Here is a breakdown of their assets at the time of Wendy’s death:

Basic reminder: The Minnesota estate tax exemption is currently $1,000,000 ($1M). Although Wendy has over $1M at the time of her death, her estate will not pay Minnesota estate taxes if her assets pass directly to Henry or to a special trust for his benefit. This is a result of the Unlimited Marital Deduction. This Marital Deduction allows the assets of a deceased spouse to pass to the surviving spouse without paying gift or estate tax. However, Wendy’s estate will still need to file a Minnesota Estate Tax return. As Wendy’s personal representative, Henry is a bit overwhelmed with all of the decisions that he needs to make. Here are three things that Henry should consider:

Value the business. Although appraising a business can be expensive, it is in Henry’s best interest to memorialize the value of Wendy’s business at the time of her death. The valuation should be completed by a qualified independent appraiser or tax professional because the appraisal is evidence of Henry’s new tax basis in the business.

Wendy had moved her store’s location last year and sales had doubled within the first three months of the move (she was a very savvy businesswoman). If the store’s key employee accepts the position of general manager, the store will likely continue increasing in value. In this case, Henry will certainly want a record of the November 2011 valuation as evidence of his step-up in basis. The reason is that upon selling the business, Henry’s capital gain (or loss) and any resulting capital gains tax are generally determined by subtracting the date of death valuation from the sale price. The greater his basis, the less tax would be due. [Note: Henry may have the option to use an “alternate valuation date” for determining his basis in Wendy’s property but we will save that concept for another article.]

Value Wendy’s other assets: For the same reason that Henry wants to value the business, it is in his best interest to value Wendy’s other assets, to create a record of his step-up in basis for capital gains and losses. For example, he will want to have appraisals done for their condominium and cabin. You may read more about basis and capital gains here.

Review or update his estate plan. Henry will want to update his estate plan and he may consider disclaiming some of the assets that he would inherit from Wendy. The result of a disclaimer is that the disclaimed property passes to the next beneficiary, as if the disclaiming individual predeceased the decedent. To make a qualified disclaimer, an individual must fulfill certain requirements. If the contingent beneficiaries under Wendy’s estate plan were her children, Henry’s disclaimer would result in her assets passing to the children.

Of course, Henry’s estate planning decisions, including whether to disclaim, will depend upon Henry’s age, health, lifestyle and most likely the estate planning documents that Wendy had in place at the time of her death. Additional factors include the health and well-being of their children and Henry’s overall estate planning objectives.

These are just a few of the many things to consider when a spouse passes away. Most importantly, Henry should consult with his financial, tax, and legal professionals to ensure that he follows all of the extensive rules involved with Wendy’s estate administration.

One thought on “Upon the death of a business owning spouse”

Comments are closed.