The slogan for many with the turn of the year has been “New Year, New Me”. In homage to this phrase, the time has come to address “New Year, New Tax Changes”. Tax changes affect most, if not all, of financial planning and that is why it is important to be conscientious of changes, especially […]

MOM AND DAD, WE DON’T WANT TO CLEAN OUT YOUR HOUSE!!

June 8, 2018

Top 5 tips for helping our aging parents (and clients) declutter A House Full of “Stuff” If you’re an adult with aging parents, chances are you’re probably going to be dealing with a house full of “stuff” in the near future. My dad still lives in the same house that he and my mom bought […]

Minnesota 529 Plan Credit

October 2, 2017

Minnesota enacted a new law in 2017 which allows individuals who contribute money to 529 College Savings Accounts either a subtraction or a credit against their Minnesota income tax liability. Contributions to the plan must be made on or before December 31, 2017 to qualify. The new law allows individuals a subtraction of up to […]

Minnesota Changes Estate Tax Law

August 2, 2017

The Old Law Minnesota estate tax law recently changed in a way that will benefit the estates of wealthy and upper-middle class people. Until recently, Minnesota’s estate tax exemption was at $1.8 million, which means a Minnesota resident could die in 2017 and leave up to $1.8 million dollars tax free to non-spouses. As one […]

Five Scams to be Aware of During Tax Season

February 14, 2017

Tax season opens up opportunities for criminals to take advantage of people. Here are five ways that you can avoid becoming a victim this tax season: 1. Phishing. You receive an email that seems to be from a legitimate sender (such as the IRS), and it demands payment for overdue taxes or requests you update […]

Tax Deductions for Estate Planning Fees

January 26, 2017

Most people know that there is a deduction allowed for the amounts you pay to have your taxes prepared by a professional. Does that same rule apply to fees paid to an attorney to plan your estate? The answer is not as straight forward as you might think it should be. The tax law provides […]

Please: get the correct acknowledgement if you want to deduct that property contribution

June 30, 2016

“Close” counts with horseshoes and hand grenades. Unfortunately, it doesn’t count for entitlement to deduct a charitable contribution, once the amount claimed exceeds a trigger point. When that happens, the taxpayer’s own records – no matter how convincing – won’t suffice. There has to be an acknowledgement from the charity itself that follows the law […]

Prince Leaves a Complex, Unplanned Estate

May 4, 2016

Unfortunately, too many recent newsletters have focused on the death of musical legends. This month left us with another untimely death. Prince, whose legal name was Prince Rogers Nelson, died on April 21st at his Paisley Park recording studio and home in Chanhassen, Minnesota. As unbelievable as it may seem, according to his sister, Tyka […]

Using a Testamentary Letter to Explain Your Estate Plan

January 20, 2016

Your estate plan likely includes formal documents (a will, perhaps one or more trusts) that direct transfers of your property when you die. But those documents won’t identify each and every item to be transferred. Eventually, whoever settles your affairs will find a sentence in one of your documents such as “I leave the rest […]

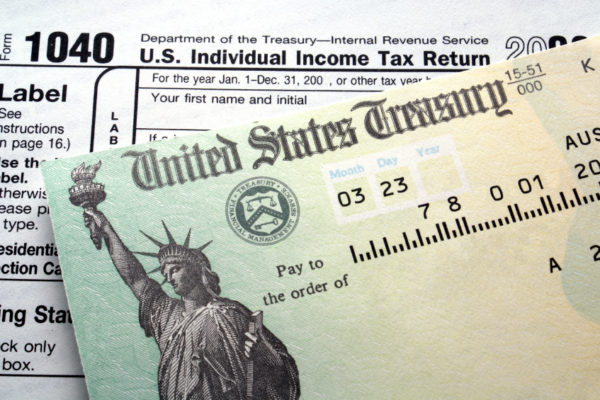

Inflation Adjustments for Estate and Gift Tax Annual Exclusion Amounts

January 10, 2016

In case you missed Internal Revenue Bulletin 2015-44, the 2016 inflation adjustments pertaining to estate planning are as follows: The gift tax annual exclusion remains at $14,000 for gifts made in 2016. The generation-skipping transfer (GST) tax exemption is $5,450,000 for transfers made in 2016. The unified estate and gift tax exclusion amount is $5,450,000 for gifts […]

The Right Way to Inherit

December 20, 2015

While an inheritance is often considered a gift by the recipient, from a tax perspective, there optimal ways to inherit a retirement account. From the language used to designate the beneficiaries to important IRS-imposed deadlines, the manner in which a retirement account is inherited can significantly affect its value. If you are the beneficiary of […]